Now that Trump is president again, there’s going to be so much to write about on this blog. But for today, let’s just start with a basic economics concept: tariffs.

Trump has been on record complaining about economics and economists. “Perhaps the profession I have the least respect for,” he once said about them. Many people probably agree. Graphs and numbers are just about the least sexy thing anyone can ever think of (well, maybe second to history and dates).

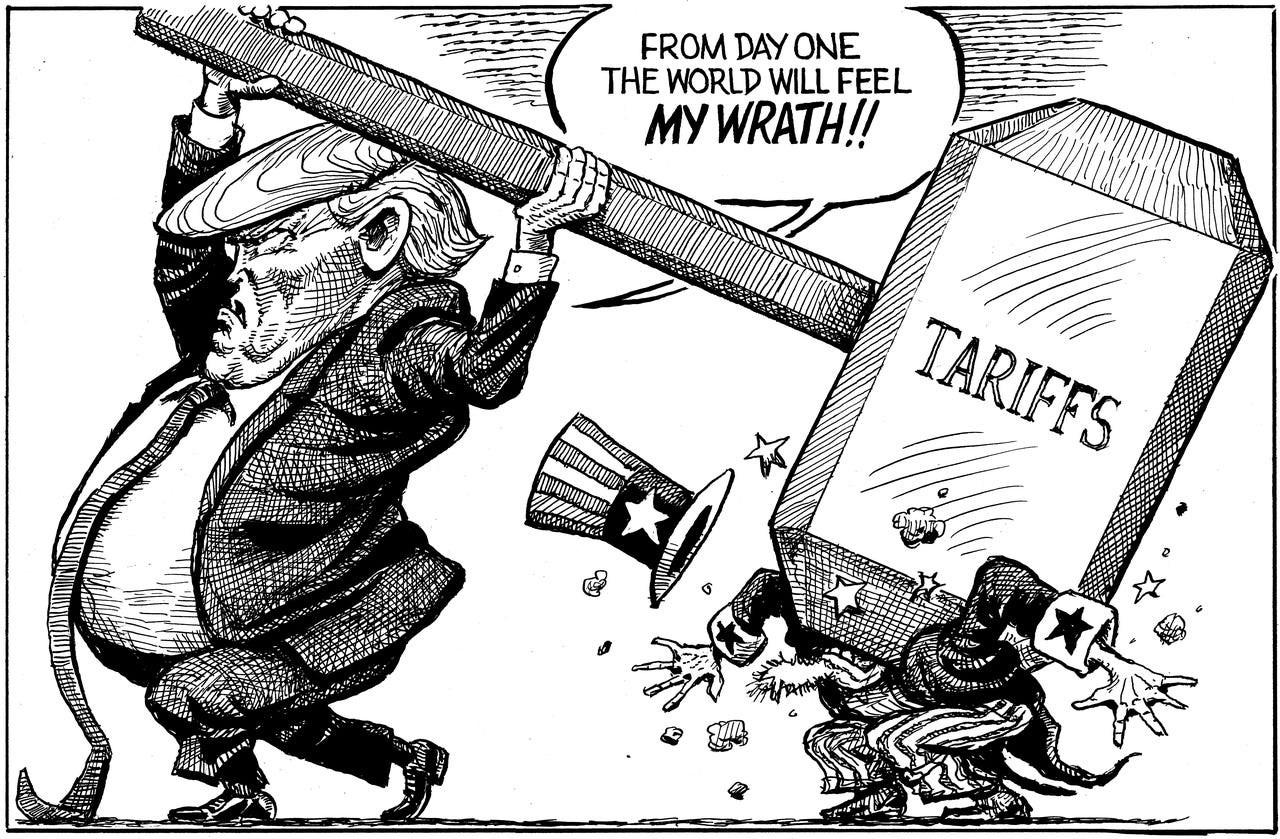

And yet, sadly, this is where we must begin — and that’s entirely because of Trump himself. Trump has changed his mind back and forth about a lot of things in his time, but if there’s just the one thing he’s always maintained since as far back as the 1980s, it’s that tariffs are great and trade wars are fun. As some might say, Trump and tariffs? Still a better love story than Twilight.

The tariffs story was looming large even before Trump took oath of office. He threatened Canada with tariffs if it didn’t become the 51st American state. He threatened Mexico with tariffs if it didn’t take back its illegal immigrants. He threatened Denmark with tariffs if it didn’t hand over Greenland. On last count, Trump has threatened literally everyone with tariffs save God himself (I was told that the jury is still out on God too, especially after a bruising sermon about mercy and morality at the Washington National Cathedral last week).

But this is not just about Trump. The idea of tariffs and trade wars clearly appeals to a large number of people all over the world. The flow of global trade has been flatlining for about a decade now as countries around the world imposed a barrage of tariffs for a spate of reasons. Countries have imposed tariffs on foreign food products to protect their farmers. They have imposed tariffs to punish enemy nations at times of war. They have even imposed tariffs in retaliation to other tariffs.

Trump’s reasons have often traversed this whole gamut and then some — and each of them have their own merits and demerits (more on them in later posts). But there is one irritating statement that I haven’t been able to get over: “Instead of taxing our citizens to enrich other countries, we will tariff and tax foreign countries to enrich our citizens,” Trump said in his inaugural address. To that end, Trump promised to set up an “External Revenue Service” ostensibly similar to the Internal Revenue Service that collects taxes from the American people.

Let’s unpack this for a moment though. Trump says that he will impose tariffs on, say, Chinese goods imported into the US, force the Chinese people to pay those tariffs, and use those tariffs to “enrich” American citizens.

But that’s not how anything of anything works. In no transaction between a buyer and a seller does the seller pay any money. Think about this the next time you go to a grocery store. Last week, I bought a carton of eggs, cereal, chicken tenders, apples, and onions. All of those items were together listed for just under $32 on the shelf. The local and state governments then levied around 2% in sales tax amounting to 63 cents. Those 63 cents are no doubt going toward public services that would “enrich the American people”. But as I stood in line at checkout, at no point did I think to ask the store owner to contribute the 63 cents from his end. It was all summarily billed to my credit card.

Typically, this is exactly how trade, taxes and tariffs work — whether at the grocery store or across oceans. Let’s say you buy a product from China which is being sold by a Chinese exporter for $100. Generally, an American importer or wholesaler would pay the Chinese seller $100 before bringing the stuff to America. When the product reaches American shores, let’s say that the US government imposes a 25% tariff on it. The importer must then pay $25 to US customs agents. The importer or wholesaler then ships off the product to retail stores across America, or sells it to retailers at a price marginally higher than the $125 he has already paid to the Chinese seller and to US customs agents (after all, everyone has to make a profit). The retailer — think Target, Safeway or Walmart — then sells it to you, the consumer, at a further profit, say, perhaps $150. The higher the tariff, the higher the price, since the importer must cough up more to make the product available to US consumers.

What makes the idea of an External Revenue Service even more comical is that tariffs are in fact paid on US soil, at US ports and airports, not abroad. No customs agents ever fly to a foreign country to collect tariffs before those products reach American shores (I mean, who’s going to pay the airfare for those “ERS agents” now? The Chinese?)

If I were to give Trump the benefit of doubt here, I’d argue that he is perhaps thinking that foreign countries are so desperate to sell to American consumers that they would be willing to lower their price to offset the higher tariffs, so that American importers, wholesalers and retailers need not pay any more than they already pay. But that doesn’t happen in the real world. As long as enough people in America are still willing to pay $150 for something that sells in China for $100, American businesses would still import the product at that price. The person who pays any taxes on a product — domestic or foreign, governmental or otherwise — is the person who buys the product.

As you might have guessed, all this is terrible news for anybody who voted for Trump because of inflation — especially the poorest (in fact, tariffs are in every sense, so much worse than income tax if you’re poor). But tariffs are also terrible news for American businesses. There are people out there who believe that if imports become more expensive, folks would be forced to buy more of products made in their own country. But except for food crops and some raw materials, most things that people buy anywhere in the world today are made through a global supply chain — research that comes from America, oil that comes from the Middle East, and steel that comes from China, for instance. Even if Trump wanted Americans to “buy American,” tariffs on raw materials and inputs from abroad will make American goods more expensive and less competitive.

There are several other pro-tariff theories floated by Trump that require further economics lessons. For one, he believes that tariffs can compel other countries to give in to America’s demands and treat the US “more fairly” (but his own previous term is proof against that idea). Two, he wants to put tariffs on countries that want to stop using the US dollar for global trade and thereby force them to use the US dollar (but that’s a bit like trying to talk down a hostage taker by shooting a hostage yourself).

I’ll be back with more on these and other issues as they evolve under Trump’s presidency. But for now, we stand at the end of this boring lecture. And you can see why Trump hates economists so much.